Best Mortgage Rates and Fees in Ohio

Bonelli Financial Group combines the wisdom of human experience and the power of artificial intelligence to deliver the best experience in Ohio mortgage lending.

We Have a Team of Licensed and Experienced Ohio Mortgage Loan Officers. Whether you're looking to buy a home in Ohio or refinance your existing Ohio mortgage loan , borrowers often dread the mortgage loan and refinance process. That is because the traditional way to shop for a mortgage loan is antiquated and broken. Bonelli Financial Group has a streamlined the mortgage loan process to be easy, fast, and exciting so you can focus on enjoying your new Ohio home and this new chapter in life without the stress of a long and complicated mortgage loan process.

Get The Best Loan Rate

We shop your loan to multiple lenders to ensure you get the best possible rate & terms.

Save Money

Unlike banks we don't have high fees and hidden costs. Total Transparency.

Save Time

We are known for fast approval & closing times to make the mortgage loan process smooth.

When searching for the best mortgage home loans in Ohio, it is crucial to consider reputable OH home lenders like Bonelli FG who offer competitive rates and lower refinance fees. Bonelli FG lenders are known for providing some of the best mortgage home loans in Ohio with favorable terms that accommodate various financial situations.

Finding the right lender can significantly impact the overall cost of your mortgage and your ability to refinance in the future. Refinancing your mortgage can be smart, especially if you can secure lower refinance fees from an OH lender. Refinancing allows homeowners to adjust their loan terms, reducing monthly payments or changing the loan duration to better fit their current financial goals.

By partnering with an OH home lender that offers lower refinance fees, you can maximize your savings and improve your financial flexibility. It is essential to thoroughly research and compare different OH lenders to ensure you get the best mortgage home loans. Look for lenders with a strong reputation for customer service, transparent pricing, and a wide range of OH home loans. This will help you find a mortgage that meets your needs while providing the most favorable terms.

With careful consideration and thorough research, you can find an OH home lender that not only meets your immediate needs but also supports your long-term financial goals, providing you with a sense of security and reassurance about your financial future. Call Bonelli Finacial Group at 480-805-8733.

Ohio Home Loans

Debt Service Coverage Ratio (DSCR) Loans

LEARN MOREFederal Housing Authority (FHA) Loans

LEARN MOREHome Equity Loans (HELOANs)

LEARN MOREHome Equity Lines of Credit (HELOCs)

LEARN MORETexas 50(a)(6) Loans

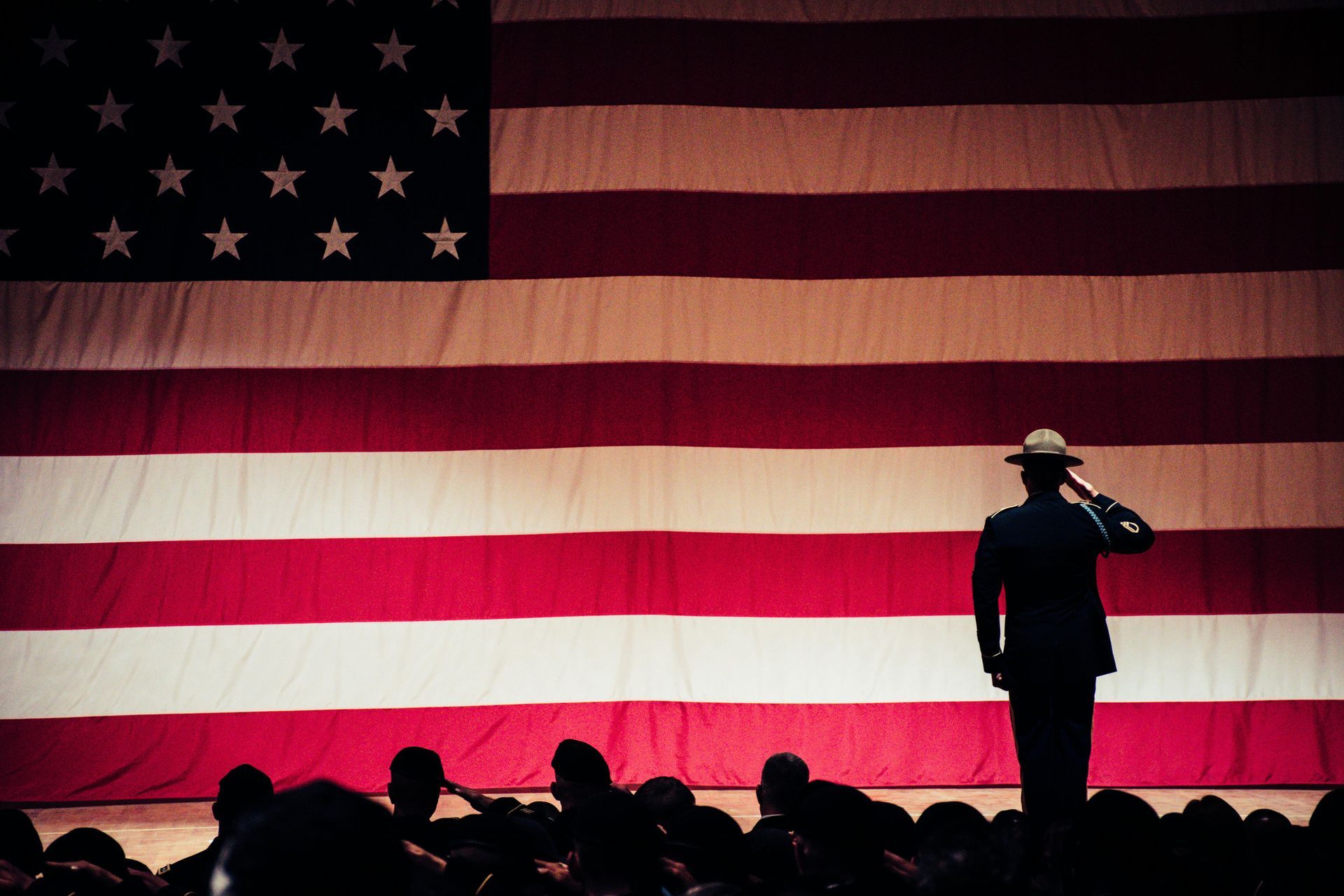

LEARN MOREVeteran Affairs (VA) Loans

LEARN MOREAbout Bonelli Financial Group in Ohio

No matter, whether you are a first-time homebuyer or looking to refinance your existing mortgage, our experienced mortgage loan officers work diligently to find mortgage home loans tailored to your unique financial situation.

The process begins with a comprehensive consultation where our expert mortgage brokers gather detailed information about your financial status, goals, and preferences. We can identify the best mortgage rates and fees by understanding your home needs.

Bonelli Financial Group Stands Apart from the Typical Ohio Mortgage Industry Lenders

Personal Approach

We believe that the mortgage process should be more than just a transaction — it should be a partnership. Unlike big lenders that treat you like a number, we take the time to understand your unique needs and financial goals. Our team provides a tailored, one-on-one experience, guiding you through each step of the process with clarity and care

Competitive Pricing

Without the heavy corporate structure and overhead costs of larger lenders, Bonelli Financial Group can offer competitive pricing that directly benefits you. We pass on the savings we gain from our efficient model to help you secure the best rates and lower fees.

Balanced Use of AI

We embrace AI to streamline and speed up the loan approval process, making it smooth and efficient. However, we never rely solely on technology. Our team is always just a phone call away, ensuring you receive the personal attention and care that every mortgage experience deserves.

Customer Reviews

In 2025, the Ohio housing market is predicted to remain relatively strong with continued growth in home prices and sales, although the pace of increase may be slower than in previous years. Factors like high interest rates and a growing population may influence the market, but Ohio is expected to remain an affordable place to buy a home.

Here's a more detailed look:

- Home Prices:

- Home prices are predicted to continue rising, though at a moderate pace, likely above inflation.

- Home Sales:

- Sales of existing homes are projected to increase slowly, while new home sales will continue to rise, potentially limited by land and labor availability.

- Affordability:

- Ohio is expected to maintain its status as a relatively affordable state for homebuyers.

- Factors Influencing the Market:

- Interest Rates: High mortgage rates may dampen demand, but buyers are increasingly accepting the "new normal".

- Population Growth: Sluggish population growth may impact overall housing demand.

- Inventory: Increased new home construction will help address the housing shortage, but there may be a glut of new homes for sale in some areas.

- Specific Market Areas:

- Columbus: The Columbus area is expected to see a moderate increase in both existing home sales and prices.

- Cleveland: Cleveland is projected to experience a more significant increase in home prices compared to other areas in Ohio.

14

YEARS IN THE INDUSTRY

200+

SATISFIED CUSTOMERS

7

AVAILABLE LOAN OFFICERS

200+

DEALS SECURED

Latest Lending and Mortgage Blog

Describe some quality or feature of the company. Write a short paragraph about it and choose an appropriate icon.